Sales of new U.S. single-family homes surged to a 19-month high in September as the annual median house price dropped by the most since 2009 amid discounts offered by builders to woo buyers, but mortgage rates flirting with 8% could curb demand.

A chronic shortage of previously owned houses is driving buyers to new construction, a situation that builders are taking advantage of by giving a range of incentives to improve affordability. The bulk of homes sold last month were in the $150,000 to $499,999 price range, the report from the Commerce Department showed on Wednesday.

"Homebuilders are offering buyers interest rate buydown incentives that funnel demand into the newly built segment," said Bill Adams, chief economist at Comerica Bank in Dallas. "They are also shrinking floorplans to boost affordability. That is leading to very different dynamics in different parts of the housing market."

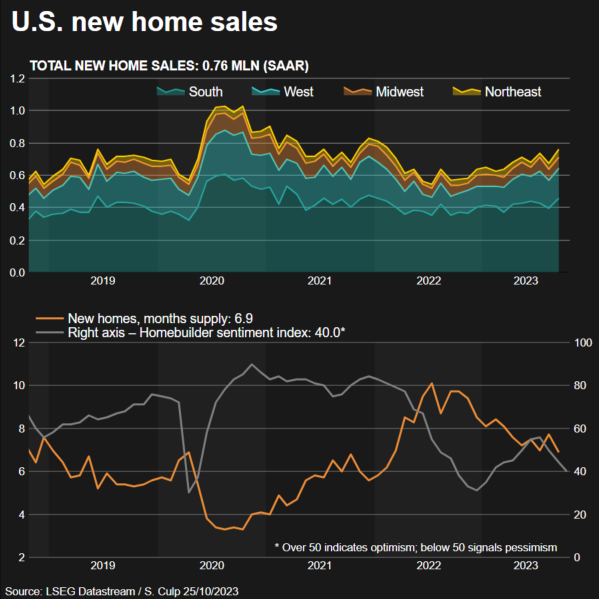

New home sales rebounded 12.3% to a seasonally adjusted annual rate of 759,000 units last month, the highest level since February 2022. August's sales pace was revised up to 676,000 units from the previously reported 675,000 units.

Economists polled by Reuters had forecast new home sales, which account for a small share of U.S. home sales, rebounding to a rate of 680,000 units.

New home sales are counted at the signing of a contract, making them a leading indicator of the housing market. They, however, can be volatile on a month-to-month basis. Sales accelerated 33.9% on a year-on-year basis in September.

Last month, new home sales jumped 22.5% in the Northeast and increased 14.6% in the densely populated South. They rose 7.5% in the West and advanced 4.7% in the Midwest.

LIMITED SUPPLY

Data last week showed home resales dropped to a 13-year low in September as soaring mortgage rates and tight supply combined to sideline first-time buyers from the existing homes market.

Single-family housing starts and building permits increased in September. But dark clouds are gathering over the new construction market, with confidence among builders deteriorating for a third straight month in October.

Nevertheless builders are trying to maintain the new housing market momentum. The National Association of Home Builders reported last week that about a third of builders reported cutting home prices in October, a 10-month high, with the average price discount at 6%.

"These smart moves are doing more than just grabbing buyers’ attention, they're making homeownership a reality for many who might have been left out in the cold given the current market conditions," said Dan Hnatkovskyy, co-founder and CEO of NewHomesMate, a marketplace for new construction homes. "This helping hand is not only making things easier for buyers but is also bringing some much-needed movement to the market."

The median new house price in September was $418,800 a 12.3% drop from a year ago. That was the largest percentage decline since February 2009. Houses in the $150,000 to $499,999 price range accounted for the bulk of transactions. There was also a notable rise in sales in the $500,000 to $749,000 price bracket.

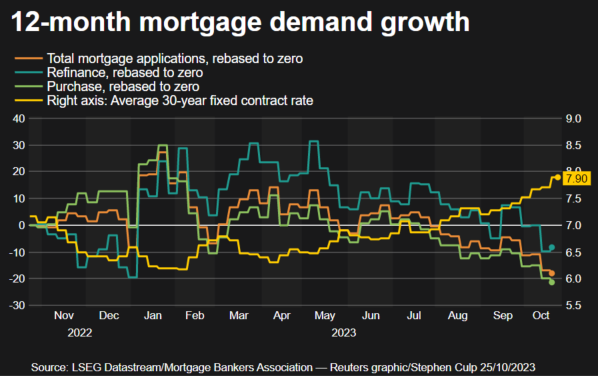

With a separate report from the Mortgage Bankers Association on Wednesday showing the popular 30-year fixed-rate mortgage averaging 7.9% last week, the highest since September 2000, new homes sales could slow in the months ahead.

Indeed, the MBA reported that the volume of mortgage applications dropped to levels last seen in 1995.

Mortgage rates have risen in tandem with a surge in the 10-year U.S. Treasury yield, which is hovering just below 5%. Government yields have spiked on concerns that the Federal Reserve could keep interest rates higher for longer as the economy continues to show resilience.

Since March 2022, the U.S. central bank has hiked its benchmark overnight interest rate by 525 basis points to the current 5.25% to 5.50% range.

There were 435,000 new homes on the market at the end of last month, up from 432,000 in August. At September's sales pace it would take 6.9 months to clear the supply of houses on the market, down from 7.7 months in August.

The housing market likely stabilized in the third quarter, thanks to strong homebuilding and new home sales.

Economists expect the government's snapshot of gross domestic product for the July-September quarter to show residential investment rebounding after contracting for nine straight quarters.

"With mortgage rates continuing to rise and homebuilder optimism surveys softening, we expect new sales to soften over the remainder of the year," said Doug Duncan, chief economist at Fannie Mae.

Source: reuters.com